Home prices are high — why is property tax revenue 'incredibly low'?

Home values impact property tax revenue, but not always in the way you'd expect.

By William Newlin

Neither Chattanooga nor Hamilton County plan to raise taxes next year. And despite all-time-high home prices, projected property tax revenues for the upcoming year are “incredibly low,” said City of Chattanooga finance administrator Vickie Haley.

Typically, the city expects to see a 2% increase in property tax revenues each year, but is looking at a 0.2% increase for the upcoming fiscal year. Combined with higher expenses, both city and county government are making budget cuts and denying some funding requests.

“This would accurately be described as a tight budget cycle,” said County Mayor Weston Wamp at his May 20 budget presentation, which has forced county leaders consider "what the most critical functions of county government are.”

Tax freezes

In Chattanooga, greater participation in the city's tax freeze program has also reduced city property tax revenues by about $1 million.

The program allows homeowners age 65 and older with annual incomes at or below $48,250 to pay the same amount of property taxes year-to-year regardless of increases to their home value or the city tax rate.

But tax freezes aren't the biggest drain on city property tax revenue. Equalization is.

What is equalization?

Equalization is a state process that aims to align the taxes paid on property appraised yearly with property appraised on a multi-year cycle. Business equipment (personal property) and utilities are appraised each year. In Hamilton County, homes and businesses (real property) are appraised every four years.

That means a homeowner's tax bill stays the same over a four-year cycle even if homes are selling for higher and higher prices. On the other hand, tax bills for utilities and business equipment rise or fall more consistently with market values. In a year when the worth of real property goes up, homes and businesses are not taxed at their full value, but other property is.

So, the state reduces the taxes paid on personal property and utilities, equalizing them with taxes paid on real property.

Equalization adjustments lowered the city's personal property tax revenue by $2.4 million, Haley said. Reduced city and county taxes paid by EPB erased $1.5 and $1.7 million from the governments’ coffers, respectively.

“In a year that’s already tough, losing $1.7 million from the property tax base wasn’t great news,” Wamp said at the budget presentation.

Learn more about equalization through this two-minute video from the state comptroller’s office.

How do Chattanooga taxes compare to the other TN cities?

Chattanooga’s property tax rate of 2.25% was the 10th-highest among Tennessee municipalities last year. The local rate is steeper than in Knoxville and Nashville, but lower than in Memphis, which ranks No. 2 in Tennessee.

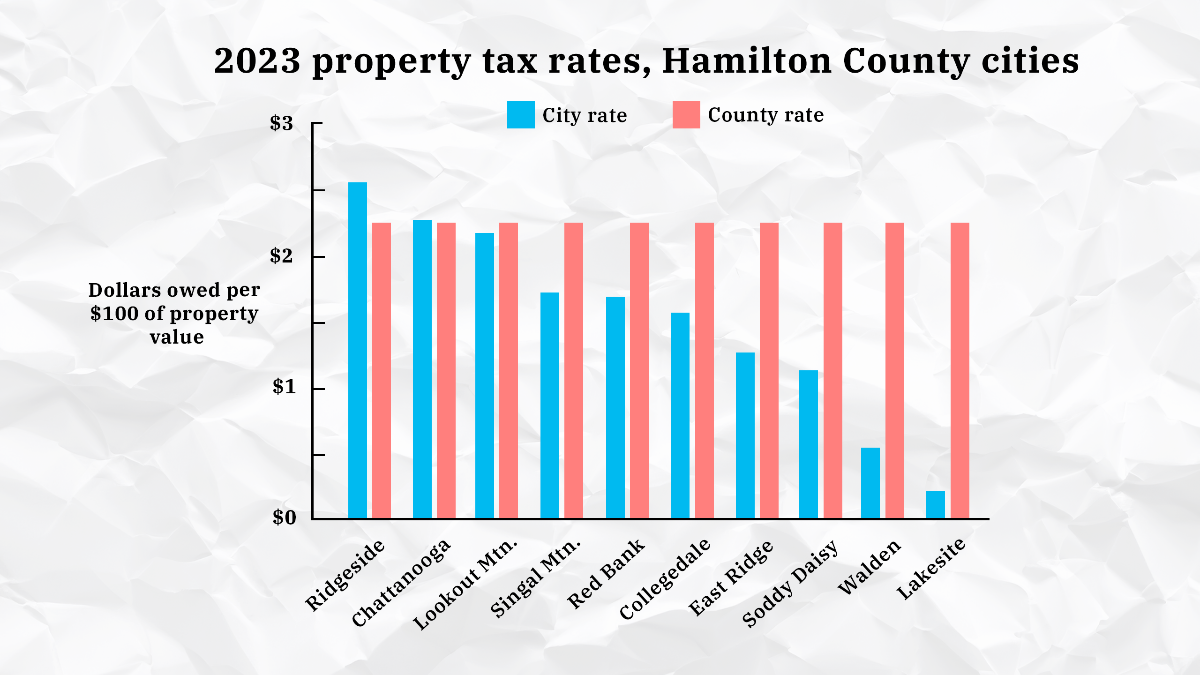

Ridgeside's property tax rate of 2.55% makes it the highest in Hamilton County. Lakesite has the county's lowest rate at 0.2%. See the chart below for a full county comparison:

What about Ringgold, GA?

The combined city and county property tax rate in Ringgold is about one-fifth of Chattanooga’s combined rate. But given differences in how property is assessed in Georgia, tax bills are even lower.

A $200,000 home in Ringgold would generate about one-quarter as much property tax as one in Chattanooga. Part of the tax break comes from Georgia's "homestead exemptions," which apply to residents who live on the taxed property.

At seven cents per dollar, the combined city and state sales tax is also lower in Ringgold. But Georgians do face a additional fees.

State income tax ranges from 1% to 5.75% based on earnings, which means that residents see a chunk of their paychecks each month go straight to the state government. Georgia also has an automobile tax, which is paid every time vehicle ownership is transferred or a new resident registers the vehicle in Georgia for the first time. Currently, the rate is 7% of the fair market value of the car. So, if you move across state lines to Georgia and own a car worth $10,000, you’ll owe $700 to the state of Georgia.

How do I calculate my property taxes in Chattanooga?

A familiar term in property tax discussions, a millage rate is the amount of property tax a homeowner owes per $1,000 of assessed property value. Millage rates don’t apply in Hamilton County and its municipalities, which calculate the property tax per $100 of assessed value.

Here's the formula:

The Hamilton County Property Assessor determines the value of all county property every four years. That’s the appraised value.

But properties aren't taxed on their appraised value — they're taxed on their assessed value. Assessed value is equal to 25% of a residential property's appraisal or 40% of a commercial property's appraisal.

The assessed value is multiplied by the city and county tax rates to calculate annual tax bills.

As an example, take a Chattanooga home with an appraised value of $200,000. Its assessed value (residential) would be $50,000.

Multiplied by the 2.25% city property tax rate, the city bill is $1,125.

Multiplied by the 2.2373% county property tax rate, the county bill is $1,118.65.