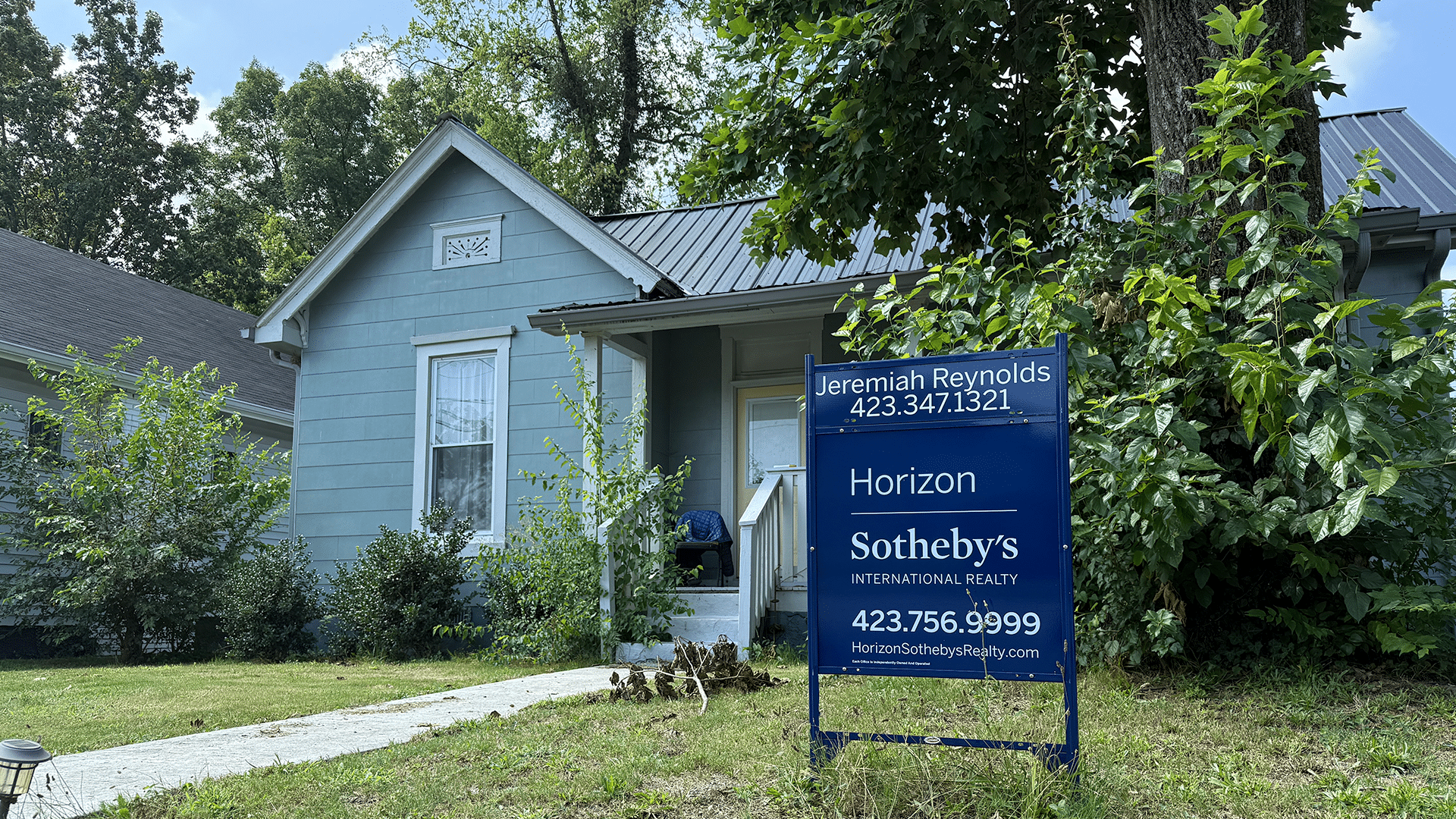

Home prices keep rising. Would a community land trust help?

With home prices out of reach for many Chattanoogans, housing advocates have pushed a long-floated but untested way to curb costs — a community land trust.

By William Newlin

It’s hard to afford a home in Chattanooga. Local home prices grew more than twice as fast as median family incomes from 2013-2023, according to data from the United States Census Bureau and Greater Chattanooga Realtors. Median sale prices remain at an all-time high.

The City of Chattanooga has already invested millions in housing affordability programs, including down payment assistance and incentives for developers.

“For all the different models and things that are being run currently, we know they do not really address the affordability issue,” said CALEB’s Economic Mobility co-chair Manuel Cruz, “because we’re living in it.”

But there’s intervention with a track record of success in communities across the U.S., and it’s still untested in Chattanooga — a community land trust (CLT).

Land trusts can shield single-family homes from speculative investment and red hot markets for generations. They’ve been part of the local housing conversation for several years, and as the affordability crisis deepens, the city’s housing office, local nonprofits, and CALEB continue to look for ways to make one work.

“ What land trusts are really, really good at is working as a steward for permanent affordability,” said Megan Miles, Chattanooga’s housing policy director.

How a CLT works

A CLT starts with up-front cash to buy parcels of land, either with or without existing homes. The initial subsidy means homes can go to low-and-moderate-income buyers below market price.

Over time, the trust retains ownership of the parcels and separates its value from the homes sitting on them. Subtracting the value of land from the sale price is one way land trust homes stay cheaper.

When homeowners move on, they don’t cash-out the same amount of equity as in a traditional home sale — a formula set by the trust determines their cut. This “limited equity resale” approach is the key to keeping a house’s price from rising to market rates in the long run.

“There’s nothing wrong with, you know, getting equity in a house,” Cruz said. “But at the point where nobody who actually lives in the neighborhood can afford it, that’s where it actually becomes a detriment to the many.”

A land trust in Chattanooga?

At the request of then-mayor, Andy Berke, CALEB released a report in 2021 on how to set up a local CLT, which can take different forms.

The report recommended using initial funding to split the cost of buying existing houses with prospective homeowners. A $5 million infusion into a Chattanooga CLT over five years could support 110 homebuyers, the report said, growing to 330 over 30 years as houses change hands.

The start-up period could be even lengthier, though. Acquiring and maintaining enough homes to make a major impact on housing would require continued funding for up to a couple decades, Cruz said, relying on both public and private dollars.

“The city can’t do it themselves, so it’s going to take partnerships,” said Janice Gooden, fellow CALEB Economic Mobility co-chair. “But it’s a model that can, you know, have a lasting impact and really make a difference.”

Who benefits

Areas with relatively high rates of outside real estate investment can benefit most from a land trust, Cruz said. According to data he compiled, around 30% of single-family homes in City Council districts 7, 8, and 9 belong to investors with at least three other properties.

The result is fewer homes and higher prices for local homebuyers. Indeed, a July 15 presentation the mayor’s office made to City Council showed that two-thirds of households in those three districts don’t own their home.

”They’ve seen an incredible increase in housing prices compared to historical,” Cruz said. “And right now, they are dominated by owners who don’t live there.”

City involvement

In both 2023 and 2024, the City of Chattanooga unsuccessfully applied for large federal grants for “permanent affordable housing solutions,” per the applications, which Miles said could have become seed funding for a local CLT.

Miles also suggested Chattanooga’s land bank could donate city-owned property to a CLT to expand its inventory, a model used in Atlanta.

“ I know there are people who are, are working on the model,” Miles said. “It’s something we hear a lot, and, you know, we would love to support an organization that is kind of out there figuring out how that could work.”

Contact William at william@chattamatters.com